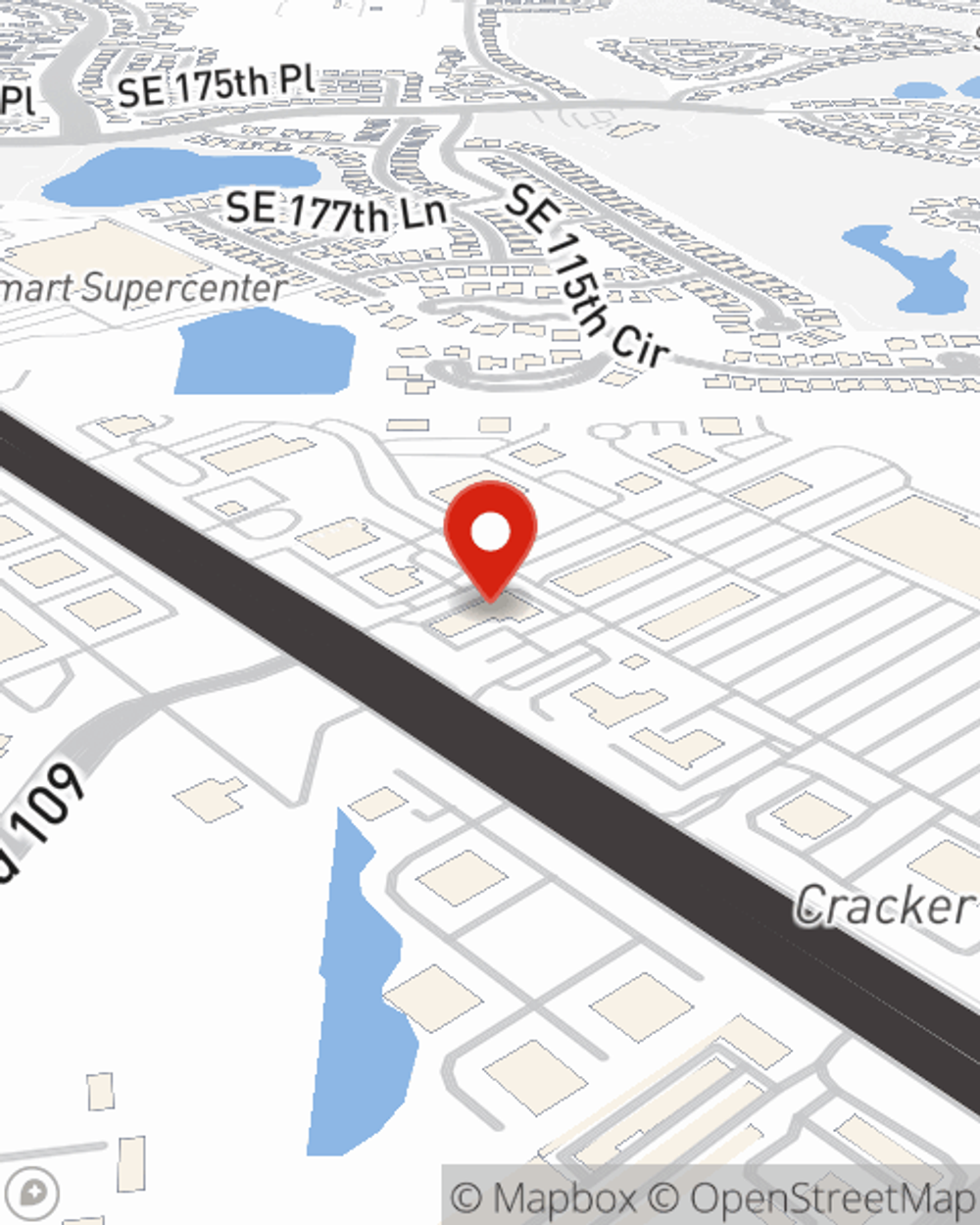

Homeowners Insurance in and around The Villages

If walls could talk, The Villages, they would tell you to get State Farm's homeowners insurance.

Help cover your home

Would you like to create a personalized homeowners quote?

Home Sweet Home Starts With State Farm

Your house isn't a home unless you enjoy coverage from State Farm. This fantastic, secure homeowners insurance will help you protect what you value most.

If walls could talk, The Villages, they would tell you to get State Farm's homeowners insurance.

Help cover your home

Homeowners Insurance You Can Trust

Agent Bradley Blessing has got you, your home, and your valuables safeguarded with State Farm's homeowners insurance. You can call or go online today to get a move on generating a plan that fits your needs.

Having great homeowners insurance can be significant to have for when the unpredictable takes place. Reach out to agent Bradley Blessing's office today to get the home coverage you need.

Have More Questions About Homeowners Insurance?

Call Bradley at (352) 307-8662 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Tips to minimize moisture in your home

Tips to minimize moisture in your home

Protect your home by eliminating excess moisture before it causes major damage. These tips on moisture resistance can help.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Bradley Blessing

State Farm® Insurance AgentSimple Insights®

Tips to minimize moisture in your home

Tips to minimize moisture in your home

Protect your home by eliminating excess moisture before it causes major damage. These tips on moisture resistance can help.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.